Unit depreciation calculator

Thanks to our price per unit. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

Depreciation Formula Calculate Depreciation Expense

According to the unit price calculator the unit price of a six pack of eggs is 19 cents per egg while the unit price of the 12 pack of eggs is 17 cents per egg.

. In addition to the printable and savable calculator tape youll discover powerful financial functions unit conversions date and time calculations product pricing functions floating and fixed point decimals multiple memory values. Generate the results by clicking on the Calculate. Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi.

Input the expression of the sum. Input the upper and lower limits. And life for this formula is the life in periods of time and is listed in cell C4 in years 5.

You can readily determine how much you can by comparing the two unit prices. Calculator for depreciation per unit of activity and per period. Provide the details of the variable used in the expression.

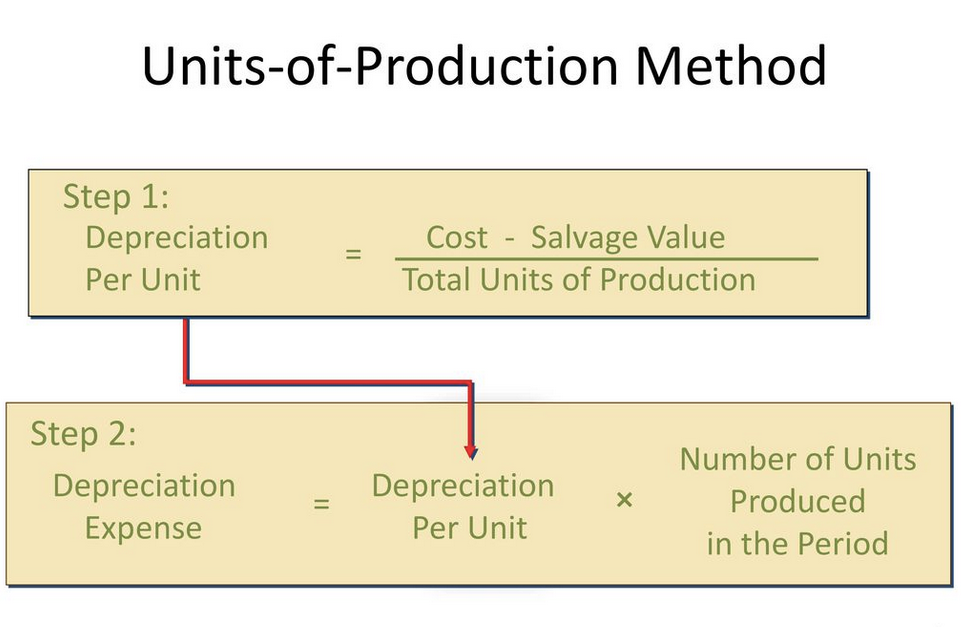

The only complain i have that I was told this led light would last for a long time but its died twice and the Whirlpool refrigerator is only two years old IcetechCo W10515057 3021141 LED Light compatible for Whirlpool Refrigerators WPW10515057 AP6022533 PS11755866 1 YEAR WARRANTY This is shown on the service. Depreciation per Unit Depreciable Base Total Units. Search a Unit to Convert.

MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. 4-8 level unit complex including lift concrete structure basement parking. How to use the summation calculator.

Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a breakdown of all the tax costs that will be taken with consideration to. Modulo Calculator You can use this modulo calculator to determine the result of modulo operations between integer numbers.

Calculate the depreciation per unit produced and for any. Unit converter allows you to check all type of metric conversion of measurement units example. The average car depreciation rate is 14.

Calculator for depreciation per unit of production and per period. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Normally these expenditures are divided by fixed or standing costs and variable or running costs.

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return. Estimate depreciation deductions for residential investment properties and commercial buildings. Activity such as units produced.

In the first year of use the depreciation will be 400 1000 x 40. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Depreciation for Period Number of Units Used in a Period Depreciation per Unit Example.

Includes formulas and example. The following methods are used by this calculator. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

The modulo operation which is also often referred to as the mod or modulus operation identifies the remainder. A P 1 - R100 n. 4-8 level unit complex including lift concrete structure ground floor parking 3185.

Based on Excel formulas for SYD costsalvagelifeper. Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. We need to define the cost salvage and life arguments for the SLN function.

For the third year the depreciable cost becomes 360 with a depreciation of 144 and so on. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Sum-of-Years Digits Depreciation Calculator.

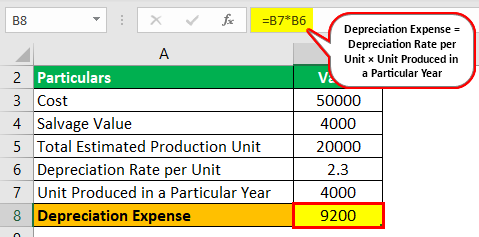

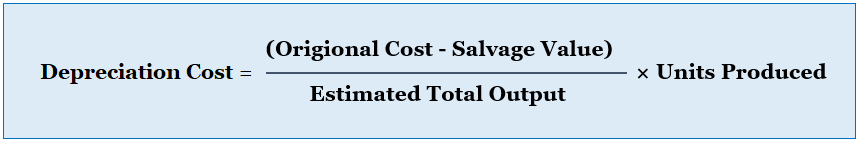

Salvage is listed in cell C3 10000. Depreciation for Period Depreciation per Unit x Number of Units Produced in a Period Example. Units of Production Depreciation Calculator.

The business purchased a bottle making machine for 750225 and you expect it to produce. The cost is listed in cell C2 50000. Fixed costs are those ones which do not depend on the distance traveled by the vehicle and which the owner must pay to keep the vehicle ready for use on the road like insurance or road taxes.

You can recover some or all of your improvements by using Form 4562 to report depreciation beginning. The unit price is the cost per ounce per pound per kilogram per liter or other units of weight or volume of an item you want to buy. More Finance Calculator Income Tax Calculator Stamp Duty Calculator VAT Calculator Salary Calculator Sales Tax.

This lets us find the most appropriate writer for any type of assignment. The car internal costs are all the costs consumers pay to own and operate a car. For example lets say youre hungry for pancakes and need to buy some flourIn the shop you have two choices.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Whirlpool Refrigerator Led Lights Flashing. D P - A.

In our example the difference is 2 cents per egg. For the second year the depreciable cost is now 600 1000 - 400 depreciation from the previous year and the annual depreciation will be 240 600 x 40. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

These expenses may include mortgage interest property tax operating expenses depreciation and repairs. You purchase a car for your business for 22000 and you expect it to have a life of 60000 miles. Depreciation per Unit Depreciable Base Useful Units.

The Car Depreciation Calculator uses the following formulae. BMT Tax Depreciation Calculator. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties. Length weight height area temperature time pressure speed force volume data storage fuel consumption energy degree number converter etc and also you can check online calculators basic advanced math calculations like percentage. You can use this summation calculator to rapidly compute the sum of a series for certain expression over a predetermined range.

Moffsoft Calculator 2 is powerful feature-rich calculator software with a simple easy-to-use interface. Includes formulas and example. Section 179 deduction dollar limits.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate. Depreciation is a tax deduction available to property investors.

A smaller package - 1 for 1 kg and a larger one - 135 for 15 kgWhich one is a better buy.

Calculating Depreciation Unit Of Production Method

How To Calculate Depreciation Expense Using Units Of Production Method Wikiaccounting

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Accumulated Depreciation Definition Overview How It Works

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

How Do I Calculate Depreciation Formula Guides Examaples

Unit Cost Depreciation General Formula Youtube

Calculate Depreciation With Units Of Production Method Depreciation Guru

Units Of Production Depreciation Calculator Efinancemanagement

Unit Of Production Depreciation Method Formula Examples

Units Of Production Depreciation Calculator Calculator Academy